Financial market over jure: stock market and IPO.

Financial management: why, what and what’s the scope of it. What are the decisions financial management makes.

Investment decisions:

- Long term: Capital Budgeting, Fixed assists/Investments

- Short Term: Working capital, Current assets.

Financing decisions

Divide the decisions:

Liquidity decisions:

Why do we invest?

We get return on the investment.

What is risk?

The fact that what actual happens Amy (and often does) suffer from what we either expect of would like to happen is defined as risk.

What is returns?

The gain and loss of a security in a particular period. The return consists of the income and the capital gain relative on an investment. It is usually quoted as a percentage.

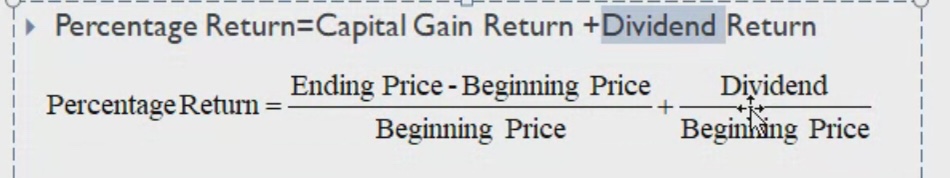

Calculating return on a stock?

If A co’s share is purchased for RS 50 and received Rs 2 as a dividend during the year.

(57-50)/50 + 2/50

Percentage return= capital gain return + dividend returns. If a share is bout at 10 INR and after a year it is sold for INR 25. During the holding period the dividend yield/return received is 2 INR. Dividend is part of profit from the company. The capital gain is 15 INR. The total return is 17 INR. Apple doesn’t share dividend. Board of directors decide whether to give dividend or not. The data comes from the board of directors.

=(25-10)/10 + 2/10

Dominos

415: beginning price

Ending price: 2152 INR

13.84 + 5/145

Google:

Share price of google in 2004: 85$

Share price of google in 2020: $1,639.43

Google gives no dividend.

(1639.43-85) /85= 18.28

Offered price(2012): 38

Facebook gives no dividend.

Ending price: 293 (2020)

Return: (293-38)/38 *100

Infosys was a very undersubscribed share.

Beginning price: 635 (2019)

Ending price: 941.45(2020)

Dividend: 9.5

Return: (0.4825 + 0.014)*100

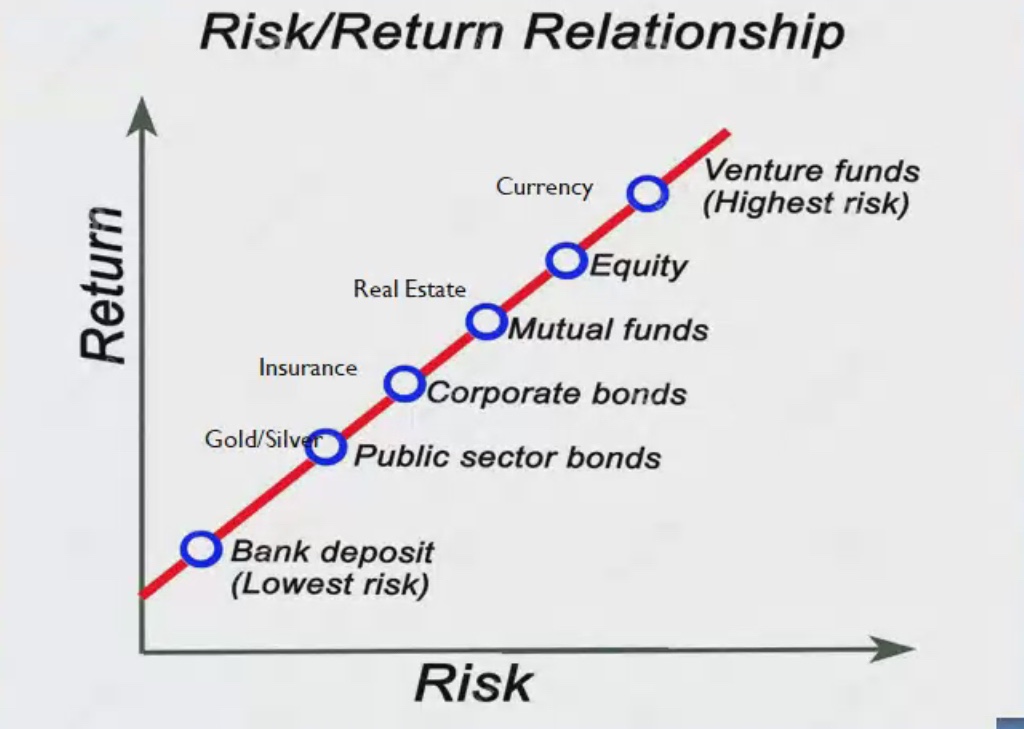

Equity: It is share market investment. We do it ourselves. It is share/stock investment. It gives dividend. It depends on the market if the money will be attained or not. It has higher risk but it has higher returns.

Debt: Giving loans generates interest. It is less risky. If someone is unable to pay the EMI, the money will be surely attained.

Mutual funds: (a+b)% interest. Where a% is fixed and b% depends according to the market.

The risks averages out. See if the company is large cap company, small cap company and medium cap company. Fund manager plays a very important role in which kind of mutual funds to go with.

Dividend funds: It is credited by bank account. It is taken by older people after 50 to 55 years of age. As there’s uncertainty what would happen next.

Growth funds: It is taken by young people who have stable income.