Does it make sense to buy a home?

If I’m “wasting” money on rent every month, I might as well pay the home loan EMI. EMI is constant, while rent increases every year.

On the other hand, I can save a lot of taxes by getting a home loan. A home is an asset that only grows in value. My dad has five times his money in the last ten years.

These are some common justifications for buying a home.

House amount:

Fill in the Loan-Related Information:

Flat cost: 1,00,000,000

Interiors cost (10-12% of flat cost): 10,00,000

Down payment percentage: <20%

Annual interest rate: 9%6

Loan period in years: 20

Number of applicants for a home loan: 1

Rental and property assumptions include an annual increase in rent of 7%, property appreciation of 7%, property maintenance appreciation of 5%, rental yield of 3%, and property maintenance cost of 1%.

Rent:

a: Details

Current Rent paid: INR 25,000

Maintenance: 3,000

Total Rental Expense: 28,000

d: Total Rent paid during the loan tenure: 1,37,74,485

Asset classes available to you:

Cash: 0%

Fixed Income:

Debt Funds (3-5%)

Gold

Real Estate (6%, 7-8%)

Stock Market/Mutual Funds (15%)

Crypto (15%+)

P2P/Invoice Discounting (8%)

Home prices in India are already in bubble territory, making investments in homes highly illiquid. This diversification strategy is therefore dangerous.

RBI knows everything about us and where our money is

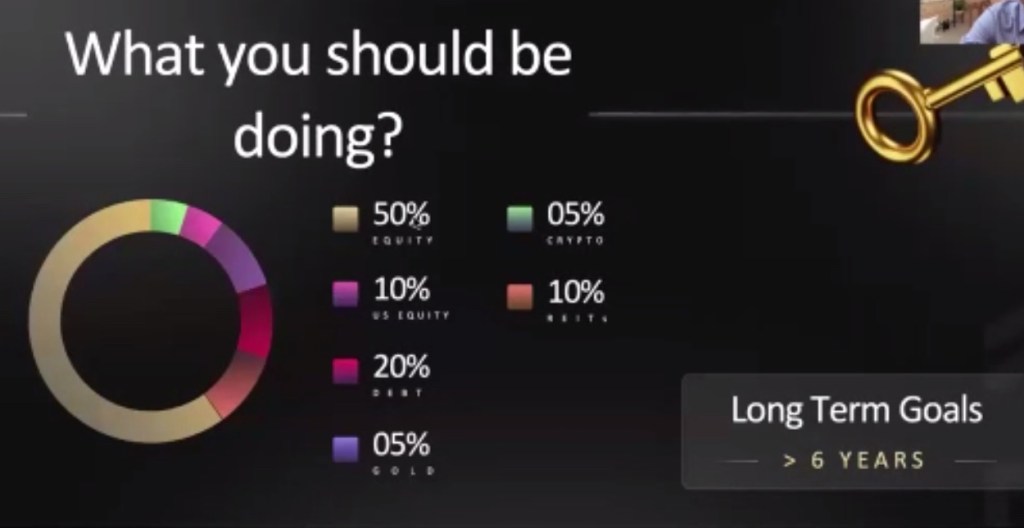

Financial goals based on an asset allocation strategy:

Short-term goals (1-3 years):

– Higher education

– Emergency funds,

– vacations

– electronic gadgets

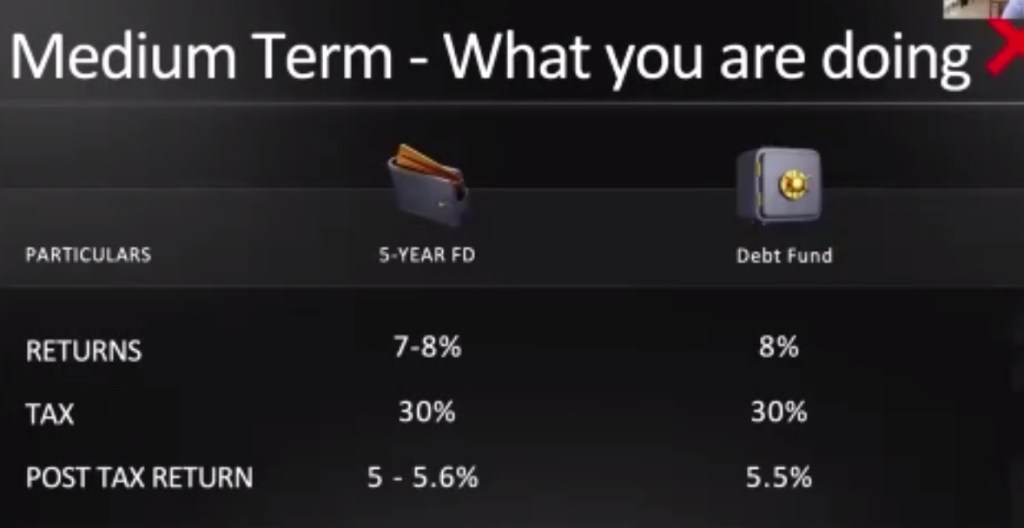

Mid-term goals (4-6 years):

– Car

– Home

Long-term goals (>6 years):

– Marriage

– Retirement

– Kid’s education

– Kid’s marriage

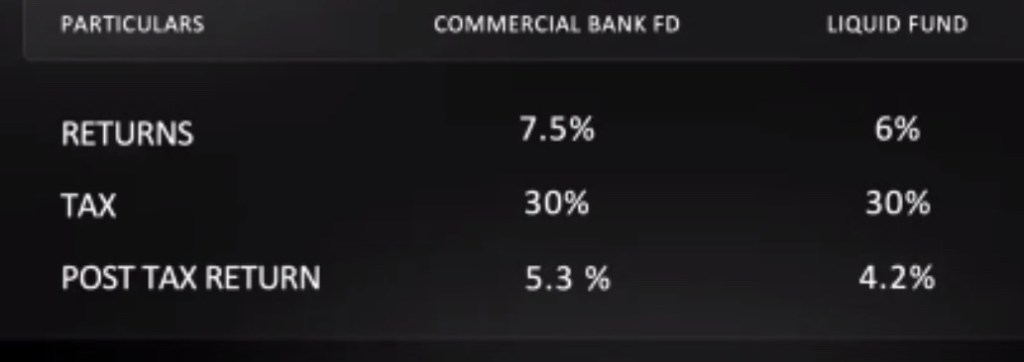

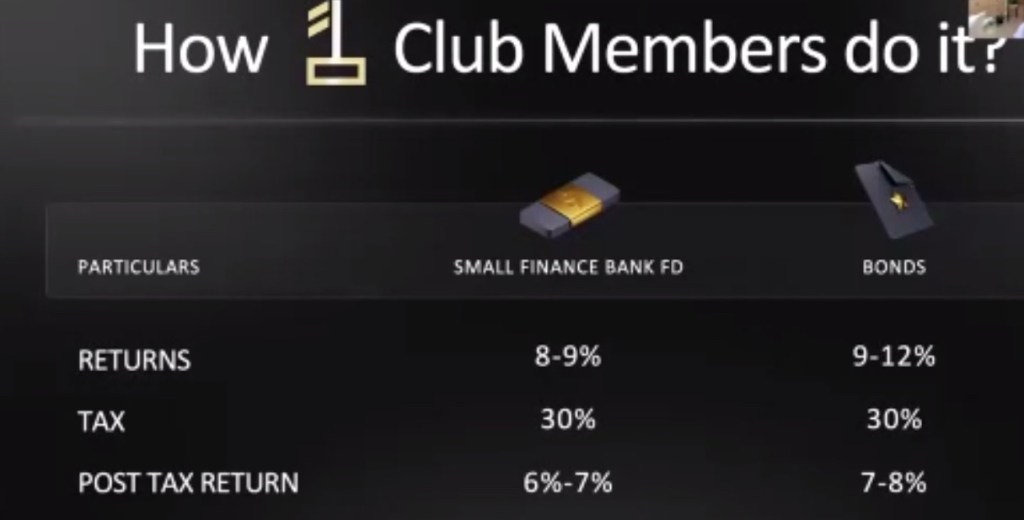

Short-term investments

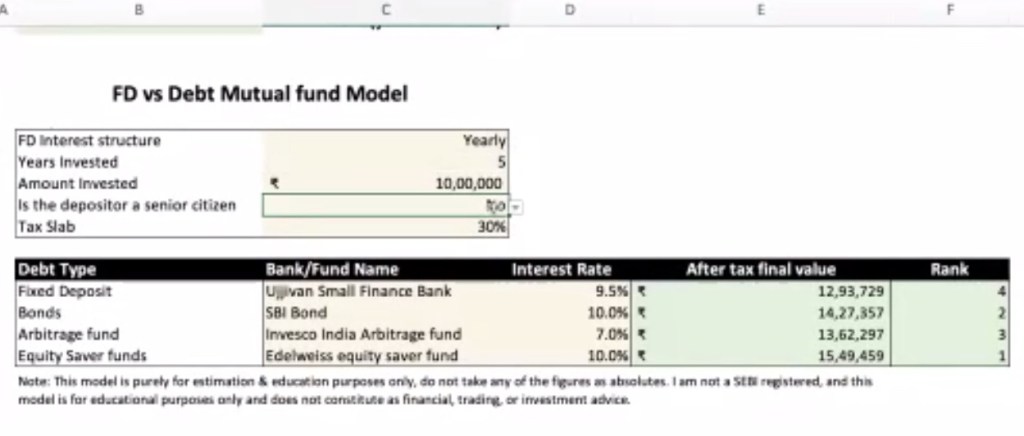

Bond is giving loan to banks. Liquid fund is like liquid mutual fund which acts like FD.

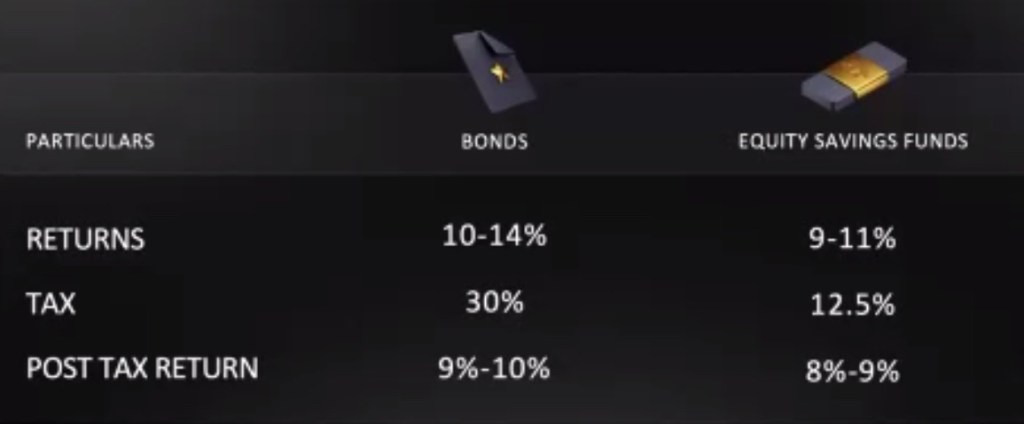

Equity saving fund is 12.5% Bonds is taxable. Equity saver is minimum tax. It’s a stock market investment. If profit is 1.25 lakhs pay 0 tax.

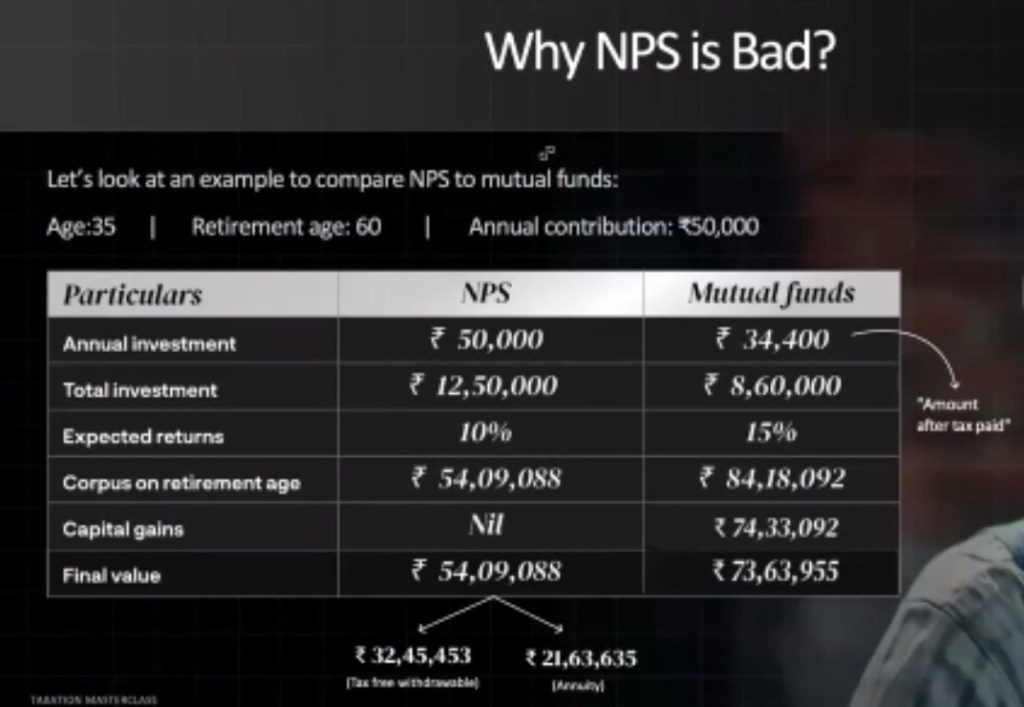

NPS invest in large caps.

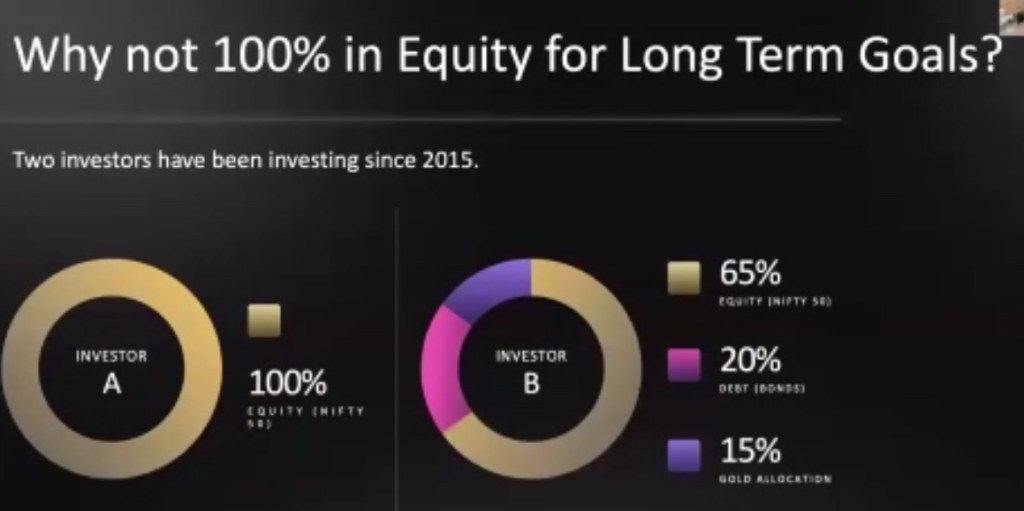

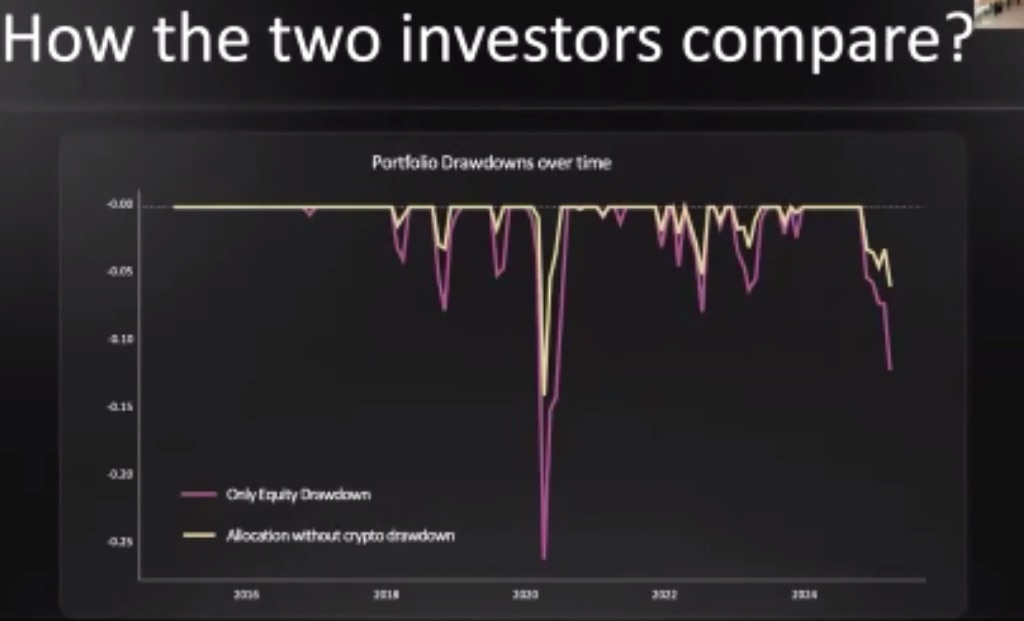

B will have more money

Least amount of risk possible

Asset allocation:

What should you be investing in?

– 50% EQUITY

– 10% US EQUITY

– 20% T

– 5% •LD

– 5% REITS

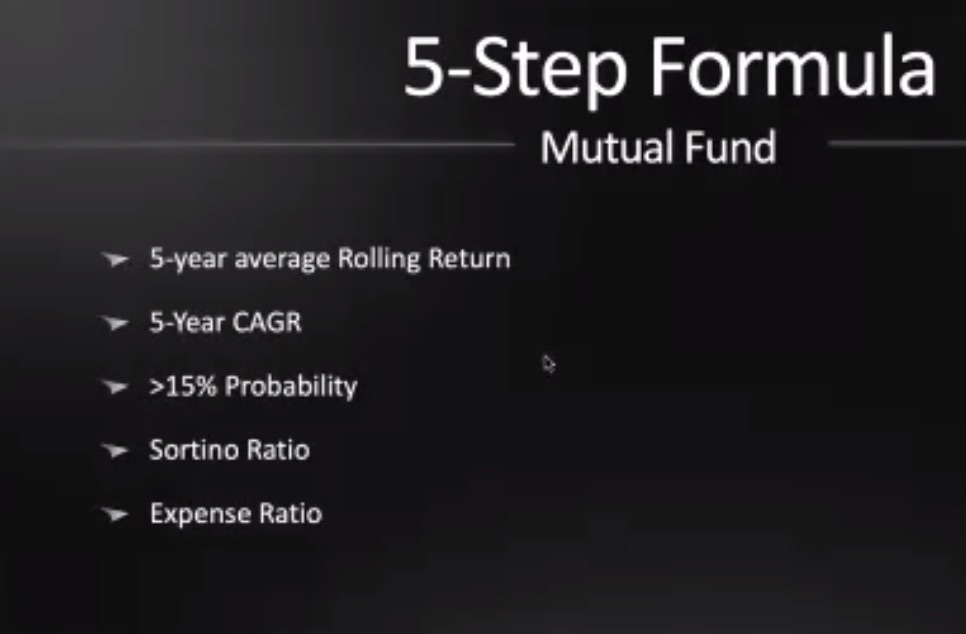

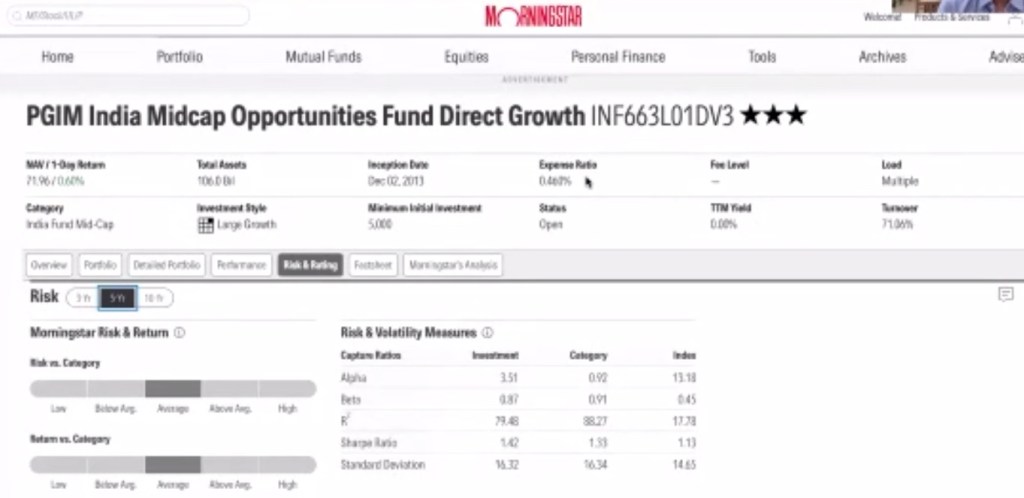

The 5-Step Formula involves a mutual fund with a 5-year average rolling return of over 15% and a ratio of greater than 1. It also has an expense ratio of less than 0.5%.

Average CAGR is fluctuating interest rates

Sorting risk taken by mutual fund to get there. https://www.advisorkhoj.com

Sharpe ratio: https://www.morningstar.com

Expense ratio:

Mutual fund distributors: they charge 2% commission

If you do it yourself, you save 0.5%

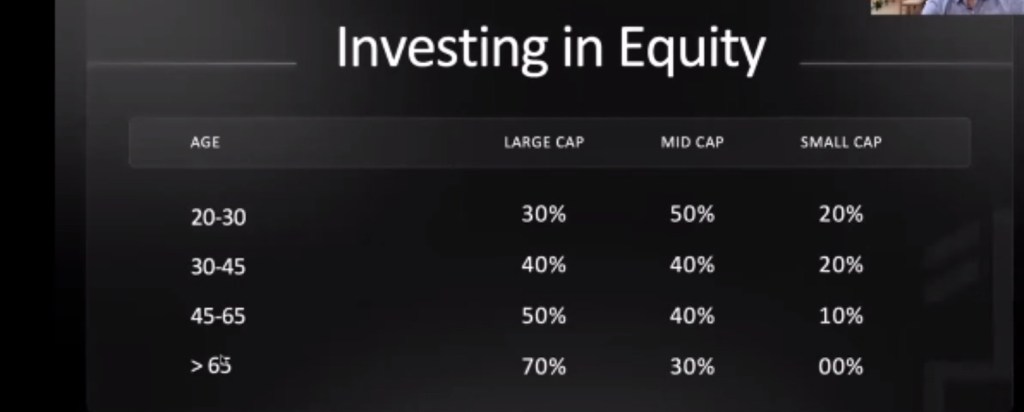

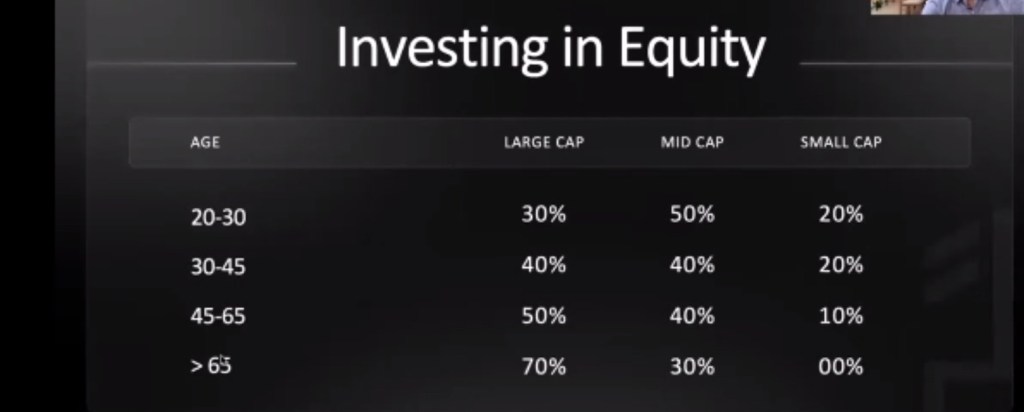

When investing in equity, it’s important to avoid focusing on the wrong factors, as they can mislead your investment decisions. Here’s why:

- Last Year’s Returns: Past performance doesn’t guarantee future results. Market conditions change, and a company that performed well last year may not sustain the same growth.

- Company Name: Investing solely based on a company’s popularity or brand recognition without analyzing its financial health, management, and growth potential can lead to poor investment outcomes.

- Thematic, Hybrid, or Focused Funds: While these funds may seem appealing, choosing them without understanding their underlying assets and strategies can expose you to higher risks.

- Net Asset Value (NAV): A common misconception is that a lower NAV indicates a cheaper or better investment. However, NAV reflects the current value of the fund’s assets and doesn’t determine performance potential.

- Friend’s Portfolio: What works for your friend may not be suitable for you. Everyone has different risk tolerances, financial goals, and investment timelines. Making decisions based on someone else’s portfolio can misalign with your personal financial objectives.

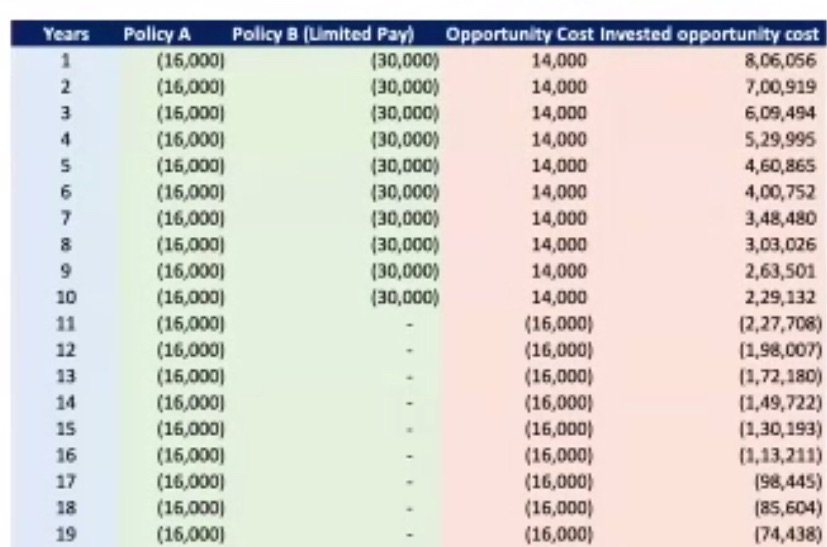

Case study: Insurance scam

Opportunity cost is money that is extra in salary but could be invested in other financial instruments

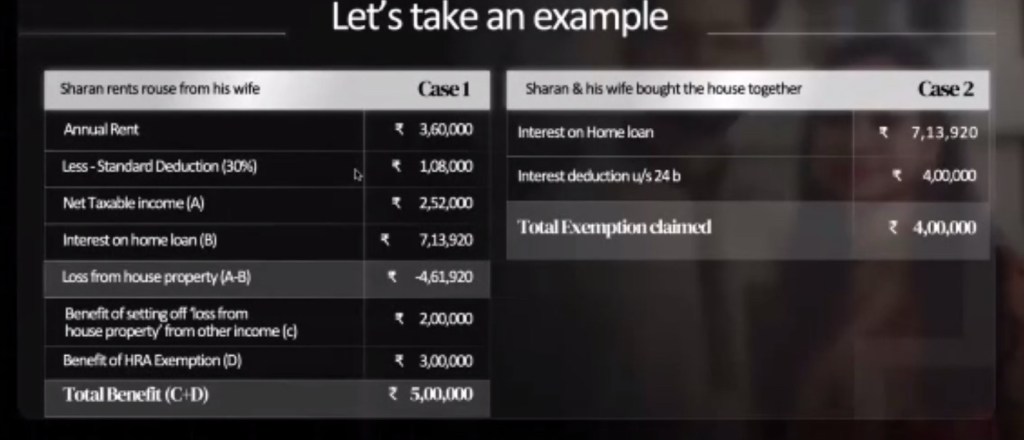

In Case 1, Sharan rents a house from his wife. Here’s a breakdown of the calculations:

1. Annual Rent: Sharan pays an annual rent of ₹3,60,000.

2. Standard Deduction: He is entitled to a standard deduction of ₹3,096, which reduces his taxable income.

3. Net Taxable Income (A): After deducting the standard deduction, his net taxable income from the house rent is ₹2,52,000.

4. Interest on Home Loan (B): Sharan has paid an interest of ₹7,13,920 on a home loan.

5. Loss from House Property (A-B): The loss from house property is calculated by subtracting the interest paid from the net taxable income. In this case, the loss is ₹4,61,920.

6. Benefit of Setting Off Loss from House Property from Other Income (C): Sharan can set off a maximum of ₹2,00,000 of this loss against his other income.

7. Benefit of HRA Exemption (D): He is also entitled to a House Rent Allowance (HRA) exemption of ₹3,00,000.

8. Total Benefit (C-D): The total benefit is the difference between the loss set off and the HRA exemption, which is less than ₹5,00,000.

Investment Strategy

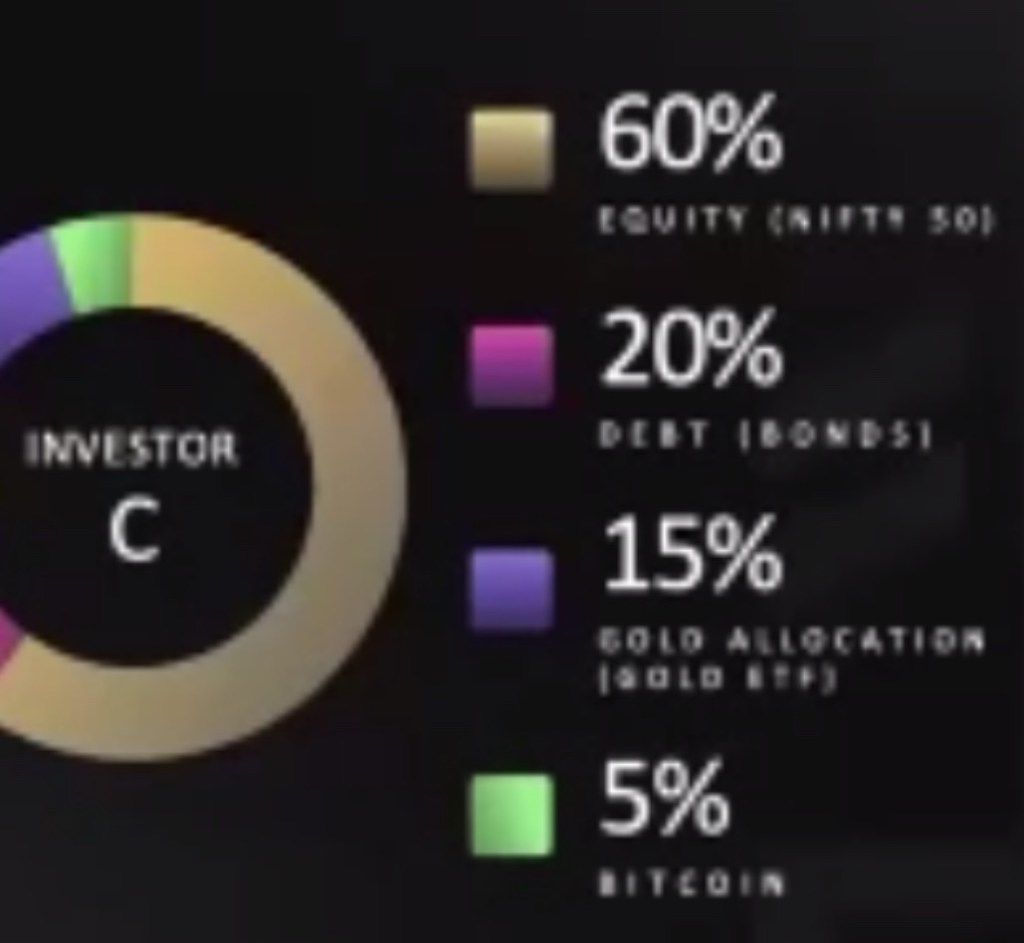

Investor C appears to have a diversified investment portfolio. Investor C’s strategy showcases a balanced approach, combining growth potential with risk management through diversification. Here’s a breakdown of their allocation strategy:

Equity (60%) – The largest portion of Investor C’s portfolio is invested in equity, indicating a focus on stocks or equity-based investments, which generally offer potential for high returns but come with higher risk.

Debt (20%) – This portion likely includes bonds or other debt instruments. These are typically more stable and provide regular income, serving to balance the risk of the equity investments.

Global Allocation (15%) – This suggests that Investor C has diversified internationally, investing in assets across global markets. This helps in spreading risk and tapping into growth opportunities worldwide.

Bitcoin (5%) – A smaller portion is dedicated to Bitcoin, indicating an interest in cryptocurrency. This is a high-risk, high-reward investment, reflecting a willingness to explore emerging asset classes.

But what if my cryptocurrency portfolio fails? If his cryptocurrency portfolio yields him nothing and completely erodes his capital, I would be devastated.

The difference between Investor A and C is 18.6 lakhs, and the difference between Investor B and C is 11.3 lakhs.

Real estate is unaffordable for us and FD is giving less interest and not beating the inflation.