How politics is influencing stock market?

Indian politics like Kejriwal or Modi atma-nirbhar or Rahul Gandhi’s how the government is handling Corona.

Global news on which the stock market is influenced

The political news has a volatile effect on market. As data scientist we should be able to mine the text and do predictive analytics using these factors.

Stock market goes high and low. It’s of two types:

- Bearish: The market is down

- Bullish: The market is going up.

Big data analysis comes from foreign accounting and stock market as it is available on the financial portal.

Why accounting?

It’s language of business. It is information science. It is concerned with analysing, collecting and organising information. It is used to measure the performance of an organisation. It provides useful information for decision making.

What’s Book keeping?

Modern society cannot function without book keeping. It’s fundamental for corporates, investment funds, banks and even individuals. Booking helps to know if operations are doing well. Also, if a product should be continued or not. Proper book keeping ensures that all necessary information is recorded and ready to use. Book keeping is the cornerstone around which all accounting is constructed. Now we have journal-keeping on Excel. Commodity exchange used to be there in older days but as currency came the book keeping came in picture.

Below the trend line it means bearish market.

Portfolio is a collection of shares/financial instruments. FD/commodities/bonds/real estate/gold.

Investment is done in bitcoins, government/textile/government based/IT

Three core financial statements of a Balance sheet, income statement, cash flow

Credit/ debit concept comes in Double Accounting system.

Luca Bartolomeo de Pacioli was the Italian mathematician on Finance who gave the concept of double accounting system.

Financial system helps know the Heath of the company and how it is doing. Balance sheet shows assets and liabilities. Cash Flow was never published.

- Single entry system or Book-keeping:

10000 INR is given is added to book of account.

- Double entry system: We record everything twice.

Shares was an example of book keeping in the past. Now due to globalization transactions are of two types:

- Cash basis: Like canteens where they hardly take any Paytm. For small vendors like auto-drivers.

- Accrual basis: Every time we can’t rely on cash transitions.

There is a contract between the Service providers and software providers there is a contract. The money is not instantly. It’s in phases. Example: Tourism, manufacturing sectors.

What is Accounting?

Classifying, summarizing, drawing conclusion, profit and loss. Stakes are higher or is a compulsion as they get audited. There’s nothing as profit and loss.

1956 amended company’s act said every company has to provide a published financial balance sheet showing profit and loss. The Companies Act, 1956 empowers the Central Government to inspect the books of accounts of a company, to direct special audit, to order investigation into the affairs of a company and to launch prosecution for violation of the Companies Act, 1956.

Debit: All the money is there but you are using your amount to transfer the amount from your account to other’s account.

There are three categories in terms of loan:

- Microfinance

- Short term

- Long term loan: Appears under liability. Example: Credit card.

Salary gets credited: income.

Loan as a businessman which is purchased on loan:

- assets: house

- liability: loan

Unlimited liability: Very small business.

Contingent liabilities: might have loss in the future. It may or may not occur. It is called conservatism. If there is loss or record it is recorded. The shareholders will be informed.

Telling everything to the share-holder is full disclosure.

Amendment of companies act 2013.

Ambani and Reliance are different entity.

If anything happens, we can’t file lawsuit against the businessman but we can can against the business.

Capital is a liability because business is different and business owner is different.

Depreciation= (Original cost-scrap value)/life of asset

Asset = liabilities + capital

We can have consistent depreciation.

All the investment should be related to SEBI.

Something for a business not for an individual where it is sold in market and you get money for it. Anything which gives economic future value to the goods.

- Tangible assets: which we can see, touch and feel. They are of two types: fixed and current assets. Plants and machinery, premises and land boundaries, computers, furniture.

- Fixed asset is greater than 1 year. Fixed always have depreciation to be charges. Long term. It does have depreciation. Example: machinery

- Current asset is less than 1 year like inventory/stock of goods, cash. Current is for immediate cash equivalent. Stock which businessman is going to see is asset. Current will never have depreciation.

- Intangible assets: Good will is intangible. HR is Intangible we can’t feel or touch. Intangible assets have amortisation.

- Cash flow: Where is the cash coming and going so the shareholders get complete information.

- Cost concept: recording the cost.

Depreciation: Accumulated deductions for wear and tear.

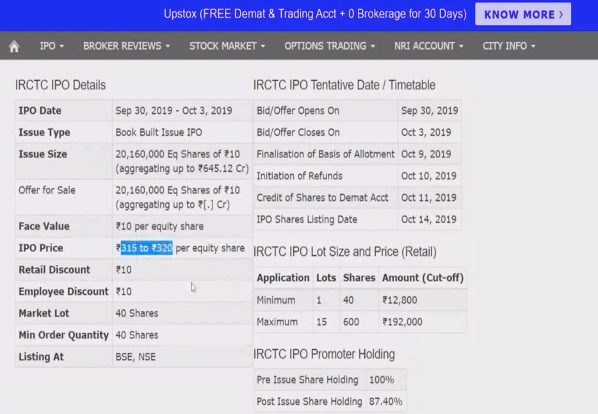

To get into secondary company needs to be primary first.

First-time the company decides to go public.

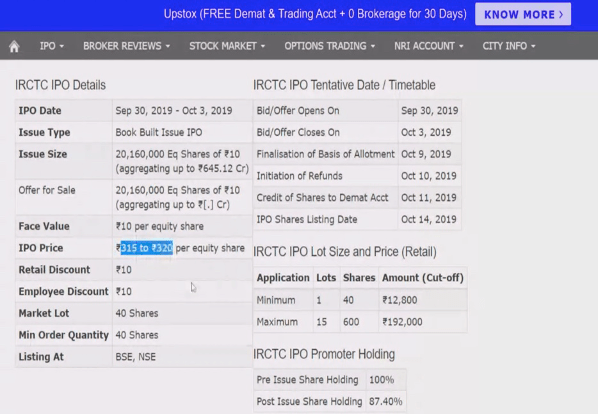

IPO: Initial public offer.

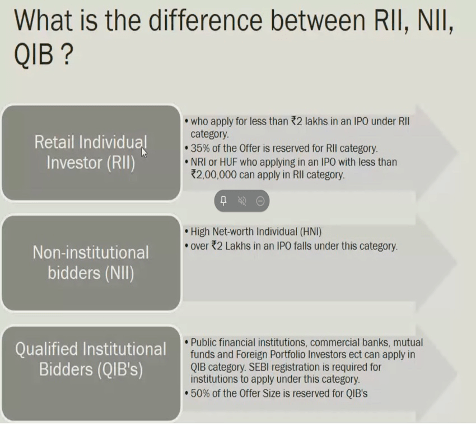

QIB= banking, insurance, mutual fund companies, venture capitalists. They invest in IPO s. The share is 50%

HII (High Institution Investors) also called as Non-institutional bidders: Who invest more than 2 lakh rupees. The share is 15%

RI: Less than 200000. Their share is 35%

This percentage is from the total allotment company decided to make.

If there is CYZ company it decides to give 10,000 shares to public the HII will have 15000 shares.

Red herring prospectus (RHP): Investors refer to this document. In this, the company lists their vision, mission and everything.

DRHP (Draft RHP): This is sent to SEBI and SEBI validates it. Once validated it gets RHP.

IPO opens for 3 days, the retail investors and HII can bid in these 3 days. For QIB the offer is open 2 days prior. They are part of the investment process. Once they invest they cannot withdraw like venture capitalists, etc.

How is it profitable for people like us I.e. retail investors. If good banking and insurance companies are investing then we can go ahead with it.

Once the bid is over and allotment is done these IPO’s are then available in market

RI can sell their IPO’s any-time after the allotment is over, HII have to wait for 1 month and QIB has to wait or 6 months for the same.

initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance.

Oversubscribed share: There are complete 10,000 shares. And there are 50000 oversubscribed. Example: Facebook. There’s a lucky draw.

Undersubscribed share: There are 10,000 share and 20,000 applicants.

The more price the more chances to get the oversubscribed share.

14th October it got listed in the market.

12,800 INR for 40 lots at a cost of 40 INR.

644.00

Issued on 25th July till 27th July 2020. (Open for 3 days)

But mobile with parallel income or the stock market.

Book built issue: process (when it is In a range)

A bid can be 1095 INR-1100 INR.

Since it is oversubscribed it should be 1100

Listed on 6th for 1739 INR.

High: 1842 INR.

For luxury items should go for parallel income.

What’s the difference between NSE and BSE?

Highest Price: 425 INR

Minimum amount: (35*425) INR

Rating based on QII.

FPO: If there are 10,000 shares, right issue or existing shareholders are asked if they want and then it is floated.

Oversubscribed share: Punjab national bank but after people got the shares through the lucky draw and there is a scam so what will happen?

Suppose there is a oversubscribed share and people get the share through lucky draw but then there’s a scam. So what will happen? Later investors to get to know about scams and it will go some way.

QIB : can to sell for 5-6 months.

https://www.chittorgarh.com/ipo/irctc-ipo/1018/

https://www.chittorgarh.com/ipo/hdfc-amc-ipo/897/

https://www.chittorgarh.com/ipo/rossari-biotech-ipo/1049/

https://www.chittorgarh.com/ipo/sbi-cards-ipo/1025/

https://www.chittorgarh.com/ipo/agarwal-packers-and-movers-ipo/955/

17th August 2020

Stock market: Watch it go up and down. 2009 we had a global crisis and bank.

NDA government. There was change in policies. We had a majority government.

The market is volatile and it does crash.

Bearish market

The stock exchange is a virtual market where buyers and sellers trade in existing securities. It is a market hosted by an institute or any government authority.

SEBI is an independent authority. It was formed in 1992. Huge penalty if guidelines are not followed.

In SEBI we don’t know from whom we are buying.

NSE: National stock exchange. Market capitalisation is $1.65 trillion. It was established in 1992.

BSE : Oldest. Established in 1875. Market capitalisation is $1.7 trillion. It’s 10th largest in the world. 5.500 companies are listed on BSE. The index is called as Sensex. It means sensitivity index.

https://getmoneyrich.com/stocks-with-high-

NSE: 50 companies (top)

Sensex 30: Top 30 companies

Diluted voting right share :

Differentiated voting tight : in some policies you get voting rights.

NSDL: national securities

CDSL: Central depositary service ltd

Trading types:

- Intraday trading: Traders buy and sell stocks on the same day. An intraday trader has to close his/her trade before closing the market. Sell it before 3:15 pm. Buy it in the morning and sell it in the afternoon. If you don’t, the system sells it for you. It doesn’t see ur you have profit or loss. They do not hold positions overnight. There’s less money in intraday.

- Delivery day: It involves buying and holding for more than one day. Stock market gives support from their side. It doesn’t involve the use of margins.

The money takes time to come to account.

- Short-selling: Selling first and buy later.

1 share 65 INR.

Share sold for 75 INR.

Profit of 10 INR.

Different share sold at 80 INR

After few days it came at 76 INR so it was bought

Profit of 4 INR

Financial management: managing business using different tools.

Sole trader/ proprietary: single owner

Partnership: Partnership act 1932. Huge number of people coming together as partners. Company’s act 1952 amended in .

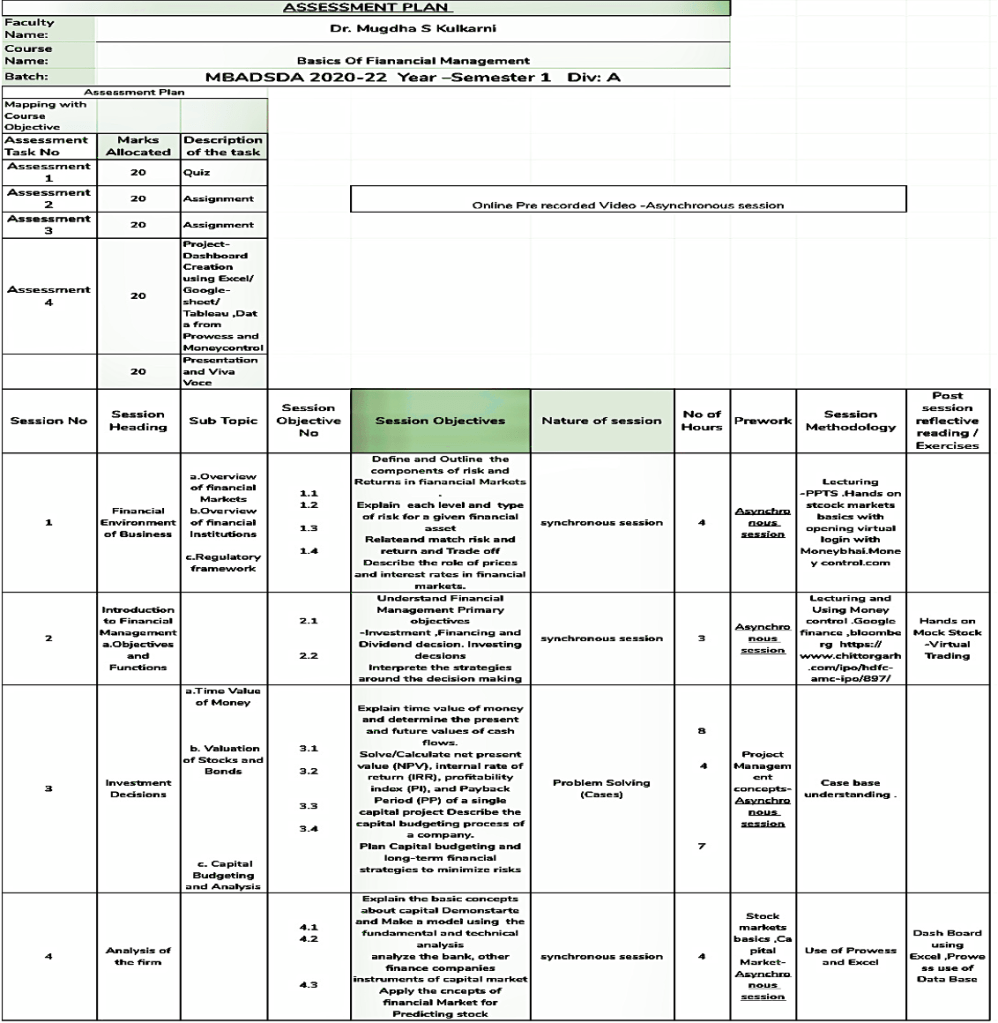

Session 2

Financial management -Objective and Functions-

- Understand financial management primary objectives

- Investment, financing and dividend decision

- Investing decision

- Interpret the strategies around decision making

Financial management: Planning, organisation, directing and controlling the financial activities such as procurement and utilisation of funds of the enterprise.

A’s of financial management:

- Anticipating financial needs

- Allocating funds in business

- Administration funds allocation

- Analysing fund’s performance

Financial management scope:

- How large should be the firm

- What should be the composition of the firm’s assets

- What should be the mix of the firm’s financing (equity/debt)

- How should the firm analyse, plan and control its financial affairs?

Goals of Financial management:

- Wealth maximisation:

- Profit maximisation:

Accounting & reporting

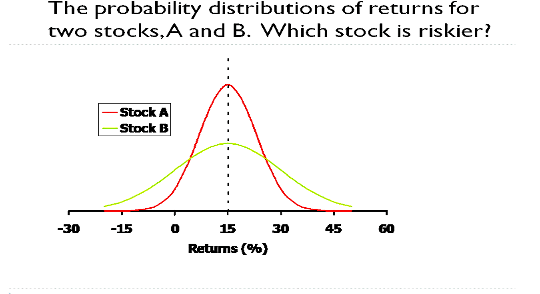

Risk is the probability of getting the money back or not getting it.

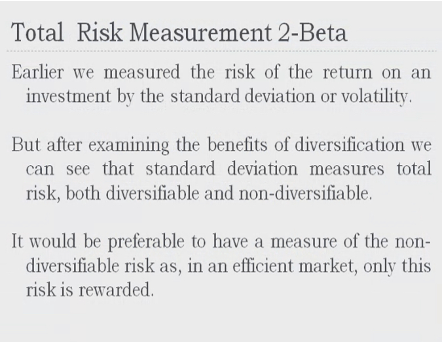

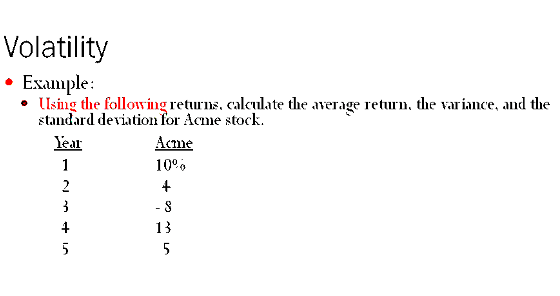

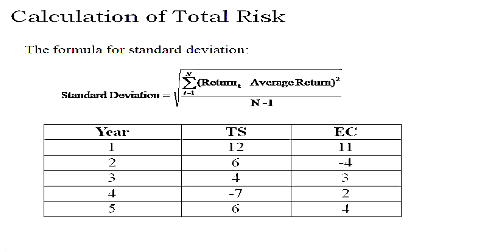

Volatility the stock moves from one amount to another. If investment is there the amount moves from one to another. It is done through standard deviation. Higher standard deviation higher the risk. Near the mean is less risky.

‘Larger the volatility greater is the risk, higher is the volatility.’

Management of profit and loss is called hedging.

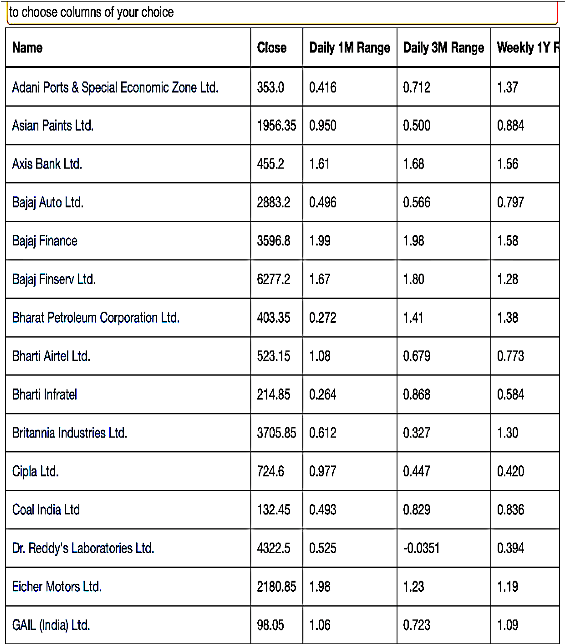

There is Systematic and unsystematic risk.

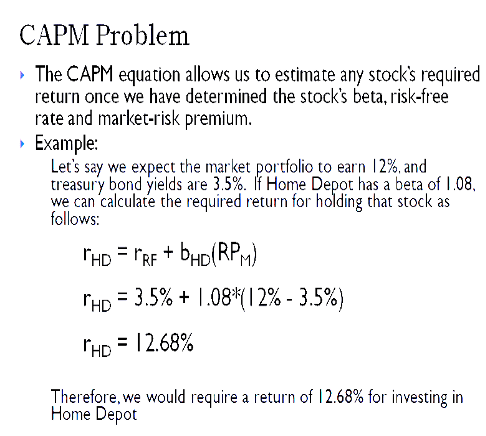

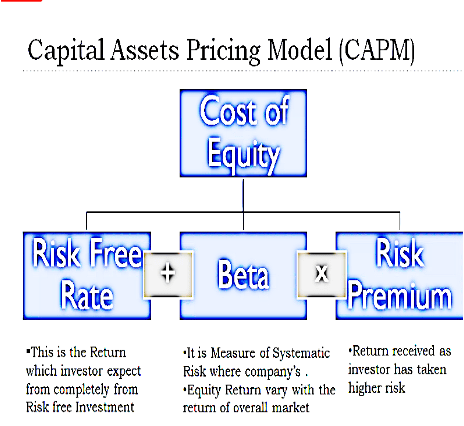

1. Systematic: External to companies like GST or corona. It is uncontrollable. It is macro nature, it is higher in nature in comparison to unsystematic the risk. It is caused by political, sociological, legal and economic considerations. Covers market risk, interest rate risk and power purchase risk. It cannot be diversified. There’s more risk in the system. The market is just going to pay for systemic risk. Systematic risk is calculating using beta :

a. Beta is between (0.5-1.0)

b. Beta= 0, it has no risk like gold, keeping amount in the bank.

c. Greater than 1: has volatility greater than the market. This has more risk but greater returns. Keeps on moving.

d. Less than 1: have less volatility than the market.

e. https://www.topstockresearch.com/rt/IndexAnalyser/Nifty50/Overview/Beta

ONGC :

Beta value = 1.03

Risk free value/FD cost : 6%

ONGC returns= 13%

Cost of equity= [6+ 1.03*(13-6)]

Risk premium = (13-6)

Unsystematic: It is industry-specific.

a. Example: Jet Airways, Kingfisher airlines. It was as the industry couldn’t balance their finances. It is caused by strikes. It doesn’t affect the investor directly. It can be reduced to a greater extent by diversification. They should invest in different classes of investment like FD, mutual funds, insurance, real estate, stock market, currency, etc. If one market isn’t doing well at least other markets doing well. There’s

diversification in the stock market?

b. https://www.moneycontrol.com/stocks/marketstats/sector-scan/bse/today.html

c. https://www.youtube.com/watch?v=LU8tubkz_Fg

d. Pager, digital diary went as soon as mobile came in. Xerox didn’t provide personalised services therefore it crashed.

Analysis of firms

Explain basic concepts about capital demonstrates and make a model using the fundamental and technical analysis

Session 1

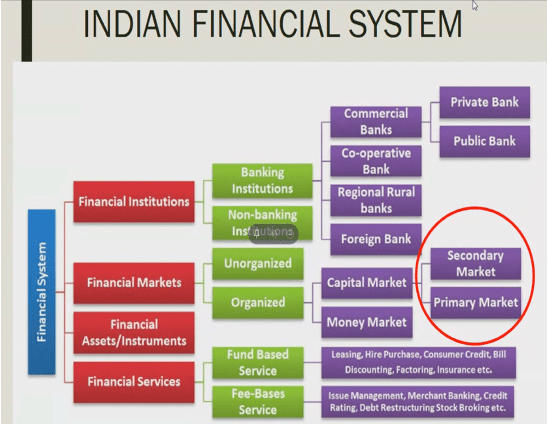

- Financial Environment of Business

- Overview of financial markets

- Overview of financial institutions

Foundations: Terms involved

Finance is both science and art.

No financial statement analysis

Basic Financial management

Terms of stock market

Investment avenues: Mutual funds, IPO, types of mutual funds

Stock marketing

Mock trading portals

No technical analysis but indications.

Predict GDP, demand forecasting will be covered.

Risk is not something we can eliminate completely. We can lower, mitigate it, and otherwise make sure it doesn’t define investments, but there will always be some risk whenever we are seeking to put in a financial reward double.” Explain.

Supposed Reliance on Gujarat election day 1 had a bit of 1.2 and an expected return of 10%. Given that the expected return on the market portfolio is 13% and the risk rating is 5%. The stock is appropriately priced B, and apprised). don’t break it lost overpriced.

The larger the volatility (standard deviation of variance) the greater the risk. Explain.

Following is the data relating to companies calculate DOL, DFL and DCL for the following installed capacity 1200 units. Actual production and sales 800 units selling price Rs.1 50. Per unit. And variable cost 100 rupees per unit. Fixed cost 20,000 INR, capital structure includes equity Rs.75,000 and debt at the rate 12% 25,000 INR.

Sanstreet, Inc. went public by issuing 1 million shares of common stock at the rate Rs.25 per share. Current risk free rate is 4% market risk premium is 8% and the company has a beta coefficient of 1.2. Capital structure also includes 8% debenture for two lakhs and 12% preference share for 2.5 lakhs. EPIT is at the rate 10% on new capital investment. Further company wishes to raise another Rs.5 million for meter expansion programme.

Suppose company analyse the following options to raise the required funds of Rs.5 million.

All equity

25% of equity share capital, 25% as preference share and 50% by the issue of 10% debentures.

Assuming that ABC Ltd belongs 25% tax bracket, calculate EPS and revise WACC.

Equity related mutual functions don’t get any tax reductions.

How politics is influencing stock market?

Indian politics like Kejriwal or Modi atma-nirbhar or Rahul Gandhi’s how the government is handling Corona.

Global news on which the stock market is influenced

The political news has a volatile effect on market. As data scientist we should be able to mine the text and do predictive analytics using these factors.

Stock market goes high and low. It’s of two types:

- Bearish: The market is down

- Bullish: The market is going up.

Big data analysis comes from foreign accounting and stock market as it is available on the financial portal.

Why accounting?

It’s language of business. It is information science. It is concerned with analysing, collecting and organising information. It is used to measure the performance of an organisation. It provides useful information for decision making.

What’s Book keeping?

Modern society cannot function without book keeping. It’s fundamental for corporates, investment funds, banks and even individuals. Booking helps to know if operations are doing well. Also, if a product should be continued or not. Proper book keeping ensures that all necessary information is recorded and ready to use. Book keeping is the cornerstone around which all accounting is constructed. Now we have journal-keeping on Excel. Commodity exchange used to be there in older days but as currency came the book keeping came in picture.

Far Luca Bartolomeo de Pacioli was the Italian mathematician on Finance.

- Single entry system or Book-keeping:

10000 INR is given is added to book of account.

- Double entry system: We record everything twice.

Shares was an example of book keeping in the past. Now due to globalization transactions are of two types:

- Cash basis: Like canteens where they hardly take any Paytm. For small vendors like auto-drivers.

- Accrual basis: Every time we can’t rely on cash transitions.

There is a contract between the Service providers and software providers there is a contract. The money is not instantly. It’s in phases. Example: Tourism, manufacturing sectors.

What is Accounting?

Classifying, summarizing, drawing conclusion, profit and loss. Stakes are higher or is a compulsion as they get audited. There’s nothing as profit and loss.

1956 amended company’s act said every company has to provide a published financial balance sheet showing profit and loss. The Companies Act, 1956 empowers the Central Government to inspect the books of accounts of a company, to direct special audit, to order investigation into the affairs of a company and to launch prosecution for violation of the Companies Act, 1956.

Debit: All the money is there but you are using your amount to transfer the amount from your account to other’s account.

There are three categories in terms of loan:

- Microfinance

- Short term

- Long term loan: Appears under liability. Example: Credit card.

Salary gets credited: income.

Loan as a businessman which is purchased on loan:

- assets: house

- liability: loan

Unlimited liability: Very small business.

Contingent liabilities: might have loss in the future. It may or may not occur. It is called conservatism. If there is loss or record it is recorded. The shareholders will be informed.

Telling everything to the share-holder is full disclosure.

Amendment of companies act 2013.

Ambani and Reliance are different entity.

If anything happens, we can’t file lawsuit against the businessman but we can can against the business.

Capital is a liability because business is different and business owner is different.

Depreciation= (Original cost-scrap value)/life of asset

Asset = liabilities + capital

We can have consistent depreciation.

All the investment should be related to SEBI.

Something for a business not for an individual where it is sold in market and you get money for it. Anything which gives economic future value to the goods.

- Tangible assets: which we can see, touch and feel. They are of two types: fixed and current assets. Plants and machinery, premises and land boundaries, computers, furniture.

- Fixed asset is greater than 1 year. Fixed always have depreciation to be charges. Long term. It does have depreciation. Example: machinery

- Current asset is less than 1 year like inventory/stock of goods, cash. Current is for immediate cash equivalent. Stock which businessman is going to see is asset. Current will never have depreciation.

- Intangible assets: Good will is intangible. HR is Intangible we can’t feel or touch. Intangible assets have amortisation.

- Cash flow: Where is the cash coming and going so the shareholders get complete information.

- Cost concept: recording the cost.

- Depreciation: Accumulated deductions for wear and tear.

To get into secondary company needs to be primary first.

First-time the company decides to go public.

IPO: Initial public offer.

QIB= banking, insurance, mutual fund companies, venture capitalists. They invest in IPO s. The share is 50%

HII (High Institution Investors) also called as Non-institutional bidders: Who invest more than 2 lakh rupees. The share is 15%

RI: Less than 200000. Their share is 35%

This percentage is from the total allotment company decided to make.

If there is CYZ company it decides to give 10,000 shares to public the HII will have 15000 shares.

Red herring prospectus (RHP): Investors refer to this document. In this, the company lists their vision, mission and everything.

DRHP (Draft RHP): This is sent to SEBI and SEBI validates it. Once validated it gets RHP.

IPO opens for 3 days, the retail investors and HII can bid in these 3 days. For QIB the offer is open 2 days prior. They are part of the investment process. Once they invest they cannot withdraw like venture capitalists, etc.

How is it profitable for people like us I.e. retail investors. If good banking and insurance companies are investing then we can go ahead with it.

Once the bid is over and allotment is done these IPO’s are then available in market

RI can sell their IPO’s any-time after the allotment is over, HII have to wait for 1 month and QIB has to wait or 6 months for the same.

initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance.

Oversubscribed share: There are complete 10,000 shares. And there are 50000 oversubscribed. Example: Facebook. There’s a lucky draw.

Undersubscribed share: There are 10,000 share and 20,000 applicants.

The more price the more chances to get the oversubscribed share.

14th October it got listed in the market.

12,800 INR for 40 lots at a cost of 40 INR.

644.00

Issued on 25th July till 27th July 2020. (Open for 3 days)

But mobile with parallel income or the stock market.

Book built issue: process (when it is In a range)

A bid can be 1095 INR-1100 INR.

Since it is oversubscribed it should be 1100

Listed on 6th for 1739 INR.

High: 1842 INR.

For luxury items should go for parallel income.

Highest Price: 425 INR

Minimum amount: (35*425) INR

Rating based on QII.

FPO: If there are 10,000 shares, right issue or existing shareholders are asked if they want and then it is floated.

Oversubscribed share

Punjab national bank but after people got the shares through the lucky draw and there is a scam so what will happen?

Suppose there is a oversubscribed share and people get the share through lucky draw but then there’s a scam. So what will happen? Later investors to get to know about scams and it will go some way.

QIB : can to sell for 5-6 months.

https://www.chittorgarh.com/ipo/irctc-ipo/1018/

https://www.chittorgarh.com/ipo/hdfc-amc-ipo/897/

https://www.chittorgarh.com/ipo/rossari-biotech-ipo/1049/

https://www.chittorgarh.com/ipo/sbi-cards-ipo/1025/

https://www.chittorgarh.com/ipo/agarwal-packers-and-movers-ipo/955/

17th August 2020

Stock market: Watch it go up and down. 2009 we had a global crisis and bank.

NDA government. There was change in policies. We had a majority government.

The market is volatile and it does crash.

Bearish market

The stock exchange is a virtual market where buyers and sellers trade in existing securities. It is a market hosted by an institute or any government authority.

SEBI is an independent authority. It was formed in 1992. Huge penalty if guidelines are not followed.

In SEBI we don’t know from whom we are buying.

NSE: National stock exchange. Market capitalisation is $1.65 trillion. It was established in 1992.

BSE : Oldest. Established in 1875. Market capitalisation is $1.7 trillion. It’s 10th largest in the world. 5.500 companies are listed on BSE. The index is called as Sensex. It means sensitivity index.

NSE: 50 companies (top)

Sensex 30: Top 30 companies

Diluted voting right share :

Differentiated voting tight : in some policies you get voting rights.

NSDL: national securities

CDSL: Central depositary service ltd

Trading types:

- Intraday trading: Traders buy and sell stocks on the same day. An intraday trader has to close his/her trade before closing the market. Sell it before 3:15 pm. Buy it in the morning and sell it in the afternoon. If you don’t, the system sells it for you. It doesn’t see ur you have profit or loss. They do not hold positions overnight. There’s less money in intraday.

- Delivery day: It involves buying and holding for more than one day. Stock market gives support from their side. It doesn’t involve the use of margins.

The money takes time to come to account.

- Short-selling: Selling first and buy later.

1 share 65 INR.

Share sold for 75 INR.

Profit of 10 INR.

Different share sold at 80 INR

After few days it came at 76 INR so it was bought

Profit of 4 INR

Financial management: managing business using different tools.

Sole trader/ proprietary: single owner

Partnership: Partnership act 1932. Huge number of people coming together as partners. Company’s act 1952 amended in .

Session 2

Financial management -Objective and Functions-

- Understand financial management primary objectives

- Investment, financing and dividend decision

- Investing decision

- Interpret the strategies around decision making

Financial management: Planning, organisation, directing and controlling the financial activities such as procurement and utilisation of funds of the enterprise.

A’s of financial management:

- Anticipating financial needs

- Allocating funds in business

- Administration funds allocation

- Analysing fund’s performance

Financial management scope:

- How large should be the firm

- What should be the composition of the firm’s assets

- What should be the mix of the firm’s financing (equity/debt)

- How should the firm analyse, plan and control its financial affairs?

Goals of Financial management:

- Wealth maximisation:

- Profit maximisation:

Accounting & reporting

Risk is the probability of getting the money back or not getting it.

Volatility the stock moves from one amount to another. If investment is there the amount moves from one to another. It is done through standard deviation. Higher standard deviation higher the risk. Near the mean is less risky.

‘Larger the volatility greater is the risk, higher is the volatility.’

Management of profit and loss is called hedging.

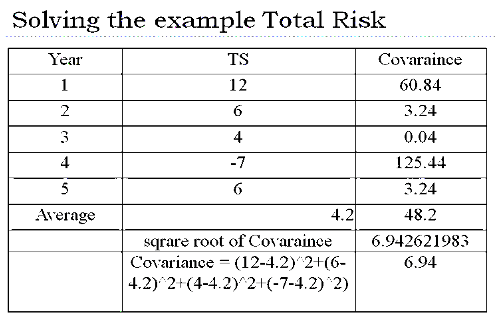

Total risk

There is Systematic and unsystematic risk.

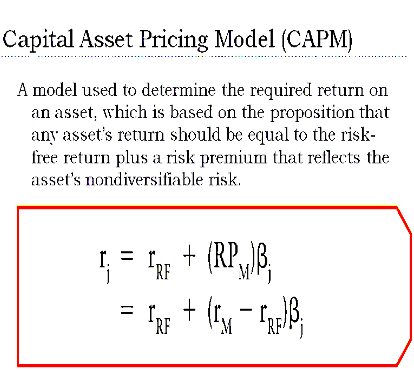

1. Systematic: External to companies like GST or corona. It is uncontrollable. It is macro nature, it is higher in nature in comparison to unsystematic the risk. It is caused by political, sociological, legal and economic considerations. Covers market risk, interest rate risk and power purchase risk. It cannot be diversified. There’s more risk in the system. The market is just going to pay for systemic risk. Systematic risk is calculating using beta :

a. Beta is between (0.5-1.0)

b. Beta= 0, it has no risk like gold, keeping amount in the bank.

c. Greater than 1: has volatility greater than the market. This has more risk but greater returns. Keeps on moving.

d. Less than 1: have less volatility than the market.

e. https://www.topstockresearch.com/rt/IndexAnalyser/Nifty50/Overview/Beta

ONGC :

Beta value = 1.03

Risk free value/FD cost : 6%

ONGC returns= 13%

Cost of equity= [6+ 1.03*(13-6)]

Risk premium = (13-6)

2. Unsystematic: It is industry-specific.

a. Example: Jet Airways, Kingfisher airlines. It was as the industry couldn’t balance their finances. It is caused by strikes. It doesn’t affect the investor directly. It can be reduced to a greater extent by diversification. They should invest in different classes of investment like FD, mutual funds, insurance, real estate, stock market, currency, etc. If one market isn’t doing well at least other markets doing well. There’s

diversification in the stock market?

b. https://www.moneycontrol.com/stocks/marketstats/sector-scan/bse/today.html

c. https://www.youtube.com/watch?v=LU8tubkz_Fg

d. Pager, digital diary went as soon as mobile came in. Xerox didn’t provide personalised services therefore it crashed.

Capital budgeting methods

1. Traditional or non-discounted methods:

a. Payback period

b. Accounting/average rate of return

2. Discounted cash flow/Time adjusted method:

a. Net present value

std dev: 8.043631021

var: 64.7

average: 4.80

In IRR, NPV is 0.

In straight line depreciation, the depreciation remains constant.

IT assets depreciates after every 36 months.

Refer AS-6

Question 03: The company is considering the investment proposal of installing new controls at a cost of Rs 50000. The facility has life expectancy of 5 years and salvage value. The tax rate is 35% Assume form uses straight line method of depreciation. The estimated cash flows before depreciation and tax (CFBT) from the investment proposal are as follows:

| Year | CFBT |

| 1 | 1000 |

| 2 | 10692 |

| 3 | 12769 |

| 4 | 13462 |

| 5 | 20385 |

Initial investment / Cash outflow= 50,000

CFBT= Cash flow before depreciation before tax /returns/profit

Calculate the payback period.

Payback = Cash flow after depreciation before

After (-)

Before (+)

Salary after tax= Deduct the tax

Depreciation

Scrap value= 0

Depreciation = (OC-Scrap)/life of assets

=50000-0/5

=10000

The last year the value of the asset will be 0.

| Year | CFBT | Depreciation | Cash flow after depreciation before tax | Cash flow after depreciation after tax at the rate 35% | Cash flow after tax before depreciation<Add> | |

| 1 | 1000 | 10000 | 0 | 0 | 10000 | |

| 2 | 10692 | 10000 | 692 | 449.8 | 10449.8 | |

| 3 | 12769 | 10000 | 2769 | 1799.85 | 11799.85 | |

| 4 | 13462 | 10000 | 3462 | 2250.30 | 12250.3 | |

| 5 | 20385 | 10000 | 10385 | 6750.25 | 16750.25 |

4+(5000-44499.95)/1670.25

Accounting Rate of return

PBP(Pay Back Period ): Cash flow after tax before depreciation.

ARR= Cash flow after tax after depreciation. Higher risk percentage is better.

(Average net earnings/initial investment)*100

((Average instead of cumulative or cash inflow)/initial investment)*100

Question 4. company requires an investment of Rs 20 lakhs and yield profit after tax and depreciation as follows:

Calculate ARR:

ARR: [(Average net earning/cash inflow)*100/Initial Amount]

(184000/20,00000)*100= 9.2%

PBP: 3+(20,00,000 -17,00,000)/660,000

=3.45 years

Depreciation: 4,00,000 INR

| Year | CFAT | Cash flow after 2 years before depreciation | Cumulative |

| 1 | 100000 | 500,000 | 500,000 |

| 2 | 150000 | 550,000 | 10,50000 |

| 3 | 250000 | 650,000 | 17,00,000 |

| 4 | 260000 | 660,000 | 23,60,000 |

| 5 | 160000 | 560,000 | 29,20,000 |

=4+[

Question 5: The company is considering the investment proposal of installing new controls at a cost of Rs. 50,000/- The facility has life expectancy of 5 years and no salvage value. The tax rate is 35%. Assume firm uses straight line method of depreciation. The estimated cash flow before depreciation and tax (CFBT) from the investment proposals are as follows:

| Year | CFBT | CIBTAD (cash income) | CFATAD (-) @ 35% | |

| 1 | 10,000 | 0 | 0 | |

| 2 | 10,692 | 692 | 449.8 | |

| 3 | 12,769 | 2769 | 1799.85 | |

| 4 | 13,462 | 3462 | 2250.3 | |

| 5 | 20,385 | 18385 | 6750.25 | |

| Cumulative | 67308 |

Straight line method is for depreciation.

Depreciation: (Original cost-scrap value)/Life of asset

=(50,000-0)/5 years)

=100,000 INR

ARR: 26.92%

225004/

Payback period: Does consider take back time value of money

Time value of money

Company needs to make investment in company too called as capital budgeting.

What are discounted methods?

The discounted methods follow time value of money. Money invested today is not the same tomorrow. The value keeps increasing due to inflation. Wholesale Price Index.

Investment should be more than inflation. If inflation if 5%, minimum investment returns should be 6%.

Reason for time-value of money:

Present value: 100

Interest value= 10%

Future value= 100*(1.10)= 110 INR

Present value= 100

Interest value= 6%

Future value= 1060 INR

- When we are coming from present value to future value we are talking about interest.

Present value= Future Value

- When we are coming from future value to present value we are talking about discount rate.

- Or present value table.

Question: How much investment we need to do if we want INR 10,00,000 at 6% at after 5years.

In modern finance, time vale of money concept plays a central role in decision supporting and planning.

Discounted cash flow DCF

Discounted cash flow is an application of the time value of money concepts- the idea that money to be received and paid at some time in future has less value, today, than an equal amount actually received or paid today.

Net profit value= Present value of future cash flow

Cash outflow= 10,000 INR

After

1 year 1000

2 years 2000

3 years 3000

4 years 4000

5 years 5000

Summation= 15,000

Question: Considering competing investments in computer equipment. Each calls for an initial cash outlay of Rs. 100, and each return a total a Rs. 200 over the next 5 year making net gain of Rs 100.

But the timing of the return is different, as shown in the table below(Case A and Case B, and therefore the present value of each year’s return is different. Using a 10% discount rate.

| YEAR | CASE A | CASE B | Present value factor | |

| Net Cash Flow | Net Cash Flow | |||

| 1 | 100 | 100 | 0.909 | |

| 2 | 60 | 20 | 0.826 | |

| 3 | 60 | 20 | 0.751 | |

| 4 | 40 | 40 | 0.683 | |

| 5 | 0.621 |

Initial investment

For Present Value Factor: www.cimaglobal.com

Sunny is planning to buy an equipment costing Rs. 5,00,000. The estimated life is 5 years. The scrap value at the end of 5 years is 50,000. The machine requires an additional investment of working capital of Rs. 1,00,000 which is recovered at the end of 5th year. The company has target return of 12% on capital and tax bracket is 50%. Evaluate the project’s NVP. Following Are the details of profit before depreciation and tax.

Scrap value= 50,000

PVF=Present value factor

Scrap Value Recovery = (Present Value Factor*additional working capital)

Scrap Value=(PVF*SV)

CFBDBT= Cash Flow before deduction before tax

CFADAT= Cash Flow after deduction after tax

CFATBD= Cash Flow after tax before deduction

Cash outflow= 5,00,000 + 1,00,000 = 6,00,000 INR

If amount is recovered, it is inflow.

Current assets like cash don’t depreciate.

| Year | PBDAT/CFBDBT | CFADBT(-Depreciation) | CFADAT (-TAX) | CFATBD (+Depreciation) |

| 1 | 1,00,000 | 10,000 | 5000 | 95000 |

| 2 | 1,50,000 | 60,000 | 30000 | 12000 |

| 3 | 2,00,000 | 11,000 | 55000 | 145000 |

| 4 | 2,25,000 | 1,35000 | 67500 | 157500 |

| 5 | 2,50,000 | 160,000 | 80000 | 170000 |

| Year | PBDAT/CFBDBT | PVF | Present Values | SV | SV recovery |

| 1 | 1,00,000 | 0.893 | 84835 | ||

| 2 | 1,50,000 | 0.797 | 95640 | ||

| 3 | 2,00,000 | 0.712 | 103248 | ||

| 4 | 2,25,000 | 0.636 | 100170 | ||

| 5 | 2,50,000 | 0.567 | 96390 | 28350 | 56700 |

| 28350 | |||||

| 56700 | |||||

| Total PV | 565325 |

A company has an investment opportunity costing 40,000 with the following expected net cash flow after taxes before depreciation.

Year 1 to year 5= Rs 7000 per year

Year 6 to year 9= 8000 per year

Determine pay-back period, NPV and Profitability Index at 10%

| Year | Amount | Cumulative |

| 1 | 7000 | 7000 |

| 2 | 7000 | 14000 |

| 3 | 7000 | 21000 |

| 4 | 7000 | 28000 |

| 5 | 7000 | 35000 |

| 6 | 8000 | 43000 |

| 7 | 8000 | 51000 |

| 8 | 8000 | |

| 9 | 80000 |

Profitability index > 1 : Good for business

Profitability index < 1: Bad for business

Profitability Index= =1.

A company is engaged in evaluating an investment project which requires an initial cash of Rs 3,00,000 INR on a machine. The economic life of the machine is 10 years and its salvage value is Rs 36,000. The project would require current asset of 64000 INR which is recovered at the end. An initial investment of Rs 60,000 would be necessary at the end of the 4th year to improve efficiency of the machine which added value to the machinery. This would be written off completely over 6 years.

The machine is expected to yield annual cash flow before tax Rs 1,20,000 for 10 years. The company follows the straight line method for depreciation. Income tax is assumed to 30% Calculate NPV if the minimum required return is 20% Should the proposal be accepted?

Outflow= Rs 3,00,000 INR

Initial Return= 1,20,000 INR

Revenue is an income.

Initial investment= 300,000 INR

Current asset= 64000 INR

Added capital investment for machinery=60,000 (4th year)

CFBDBT= Cash Flow Before Deduction Before Tax

CFATBD = Cash Flow After Tax Before Deduction

CGADAT

| YEAR | CFBDBT | Depreciation | CFADBT |

| 1 | 120000 | 26400 | 93600 |

| 2 | 120000 | 26400 | 93600 |

| 3 | 120000 | 26400 | 93600 |

| 4 | 120000 | 26400 | 93600 |

| 5 | 120000 | 26400 + 1000 | 83600 |

| 6 | 120000 | 26400 + 1000 | 83600 |

| 7 | 120000 | 26400 + 1000 | 83600 |

| 8 | 120000 | 26400 + 1000 | 83600 |

| 9 | 120000 | 26400 + 1000 | 83600 |

| 10 | 120000 | 26400 + 1000 | 83600 |

| CGADAT (-TAX) | CFATBD (+Depreciation) Inflows |

| 65520 | 91920 |

| 65520 | 91920 |

| 65520 | 91920 |

| 65520 | 91920 |

| 58520 | 94920 |

| 58520 | 94920 |

| 58520 | 94920 |

| 58520 | 94920 |

| 58520 | 94920 |

| 58520 | 94920 |